Roth IRAs vs. Traditional IRAs - Which One is Right for Me?

As we approach year end, it is natural for many of us to think about our tax situation, and by extension our investments and how we might better utilize our investments to provide more tax benefits.

In a previous post, we described how IRA accounts can be a powerful tool for reducing your taxes over the course of your life. We also described the basic timing difference as it relates to the tax nature of a Roth IRA vs. a Traditional IRA. However, we'd like to refresh you on the concept and expand on the differences between Roth and Traditional IRAs and help you figure out which one is right for you.

Timing Differences:

With a Traditional IRA you get a tax deduction now for your contributions (meaning you reduce your tax liability in the current year) but you need to pay tax on your distributions when you pull the money out in retirement.

With a Roth IRA, you don't receive any kind of tax deduction for your contributions, but you never have to pay tax again on the principal or gains when you begin taking distributions in retirement.

As a result of this timing difference, there are a number of items you need to take into consideration when determining which one is best for you:

Income Limits:

The deduction for your Traditional IRA contribution (the main reason you would utilize a Traditional instead of a Roth) begins to phase out if you make over $61,000 as a single filer, or over $98,000 if you are married filing jointly. These are 2015 limits, and they change each year. You can check the most recent IRS rules here.

Please note: the deduction limits only come into play if you have a qualified retirement plan through your employer (i.e. 401k, 403b, 457b, etc.). If you do not have a qualified retirement plan through work then it doesn't matter how much money you make, you can still deduct your Traditional IRA contribution.

Roth IRA contributions are not allowed if you make over $131,000 if single and $193,000 if married filing jointly. The allowance of how much you can contribute begins to phase out at $116,000 and $183,000 for single and MFJ, respectively.

So if you make over the Traditional IRA income limit, then it's pretty easy to see that a Roth is the best option for you because utilizing a Traditional IRA without the upfront deduction defeats the whole purpose.

If you also make enough money that you are over the Roth IRA contribution limit, then you will need to utilize a current tax loophole that is known by many as a "backdoor Roth" or "ghosting into a Roth." We will create a separate post to detail this strategy, so stay tuned.

Tax Rates:

When considering whether you want to pay tax now or later, you need to consider the marginal tax rate you will be paying on that income. There are two primary questions worth trying to answer:

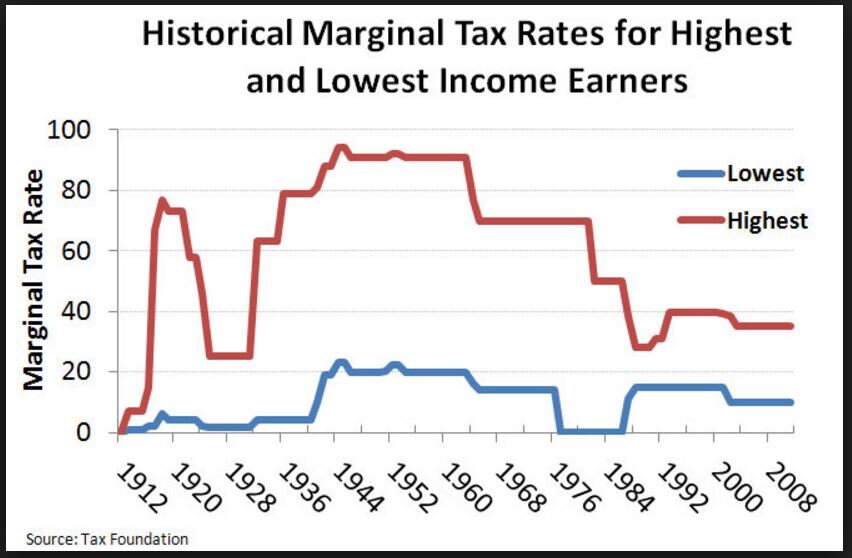

- When you retire, will tax rates be higher or lower?

- When you retire, will you be making more money or less money than you are now?

Nobody can be completely sure about the answer to these. However, if you look at historical income tax rates, it is pretty obvious we are near some of the lowest rates we've had since personal federal income tax was first mandated. Additionally, given the budget deficit issues facing the federal government, it is hard for us to see them getting much lower (it is likely we see them higher in the future).

In regards to the second question, it completely depends on your specific situation but most people report lower taxable income during retirement as a result of being able to live on less (hopefully the kids' college and your mortgage are paid for) and therefore needing to pull less out of retirement assets. If you are currently in a mid to low tax bracket we usually would recommend a Roth. If you are near the top marginal tax bracket currently, this requires more thought and analysis. As this can be a tricky question to answer, we would be happy to work with you to help you better understand your individual situation.

Withdrawal Rules:

The IRS requires that you take minimum distributions from a Traditional IRA beginning at age 70.5, while Roth IRAs have no set rules mandating a distribution. Therefore, if you are going to be in a situation where you won't need the money until much later in life (or not at all), then a Roth is going to allow you to compound your money tax-free for a longer period of time.

Cash Flow Needs and More Liquid Savings:

Theoretically, a Traditional IRA contribution is going to give you more cash in the near term due to the tax deduction you receive that will allow you to potentially get a check back from the IRS come tax return season. This may be a good reason to utilize a Traditional IRA if you want to save for retirement but have some short-term saving needs such as building your emergency fund or needing cash for a home down payments.

We say "theoretically" though because we aren't convinced that people who go this route for the sake of near-term liquid savings actually end up saving it. More often we find that somehow the tax return money gets spent on something that wouldn't have been purchased if the money never came back to us. So be wary of borrowing from your future for the sake of "short-term savings."

Which One is Actually Going to Result in the Most Money in My Pocket?

While it all depends on your individual situation, we believe it is most likely the Roth will end up creating the largest benefit to your net worth over time. The primary reason this is true is because the contribution limits are the same, even though one will be taxed in the future while one will not.

Imagine you put $5,500 into a Roth and your Spouse puts $5,500 into a Traditional with identical investments and timing every year until you retire. Then you distribute the same amount of "after-tax cash" out for spending needs from each. Since you will be paying tax on the Traditional distributions you will need to distribute more each year from that account (potentially 20-25% more), meaning the Roth money will last significantly longer.

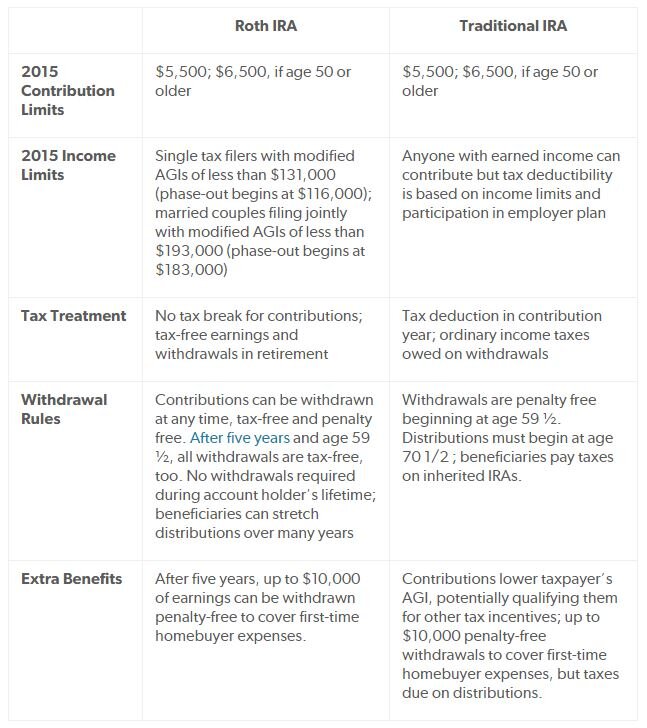

Nice Summary Table:

Source: RothIRA.com

There are a lot of factors that weigh on the decision of which account type you should use. Additionally, there are other tax strategies, outside the scope of this post, that could swing the pendulum one way or the other depending on your individual situation. Please feel free to reach out and contact us if you have specific questions or if you would like to open a Roth or Traditional IRA account.

More Advanced Strategies We Will Discuss in Future Posts:

- Planning Roth conversions during low income years

- The Roth conversion "Mulligan"

- Backdoor Roth contributions when over the income limits