Top 2015 Investment Stories and 2016 Expectations 3: Houston We Have a Problem

Oil

Source: Bloomberg

The above chart tells the story. Oil's (WTI) last peak was mid-June 2014 at around $107/barrel. Since then oil has fallen to around $29/barrel. This is the largest peak to trough decline on record at almost 73%. First, what happened:

In November of 2014, with oil already teetering (already down to around $77/barrel), primarily due to a significant increase in US production as a result of the shale revolution financed by cheap credit, OPEC declined to cut production. In effect, OPEC declared a price war to maintain their market share. When we say OPEC we mean primarily Saudi Arabia.

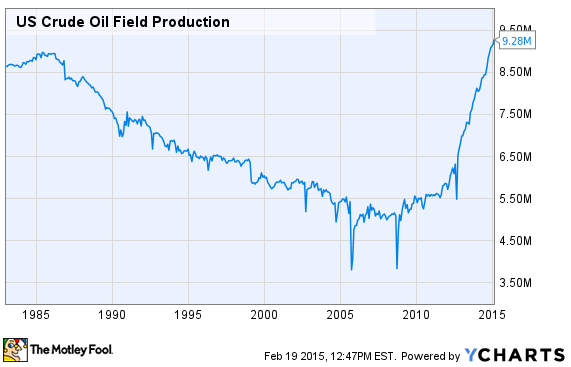

It's worth looking at the increase in US production over the last five years because it is pretty incredible and you can begin to understand why Saudi Arabia would take such a hard line:

Source: YCharts, EIA data

This chart shows we are now producing at record leverls, something that even five years ago seemed crazy. But here we are. Effectively we went from producing five million barrels of oil a day in the US to producing over nine million. This had significant knock-on effects for the rest of the world because other countries were not decreasing their oil production in response to the US. So, net, net the rest of the world all of a sudden had an additional four million barrels of oil a day. It didn't happen overnight but eventually supply outstripped demand and we get the chart at the top of the page.

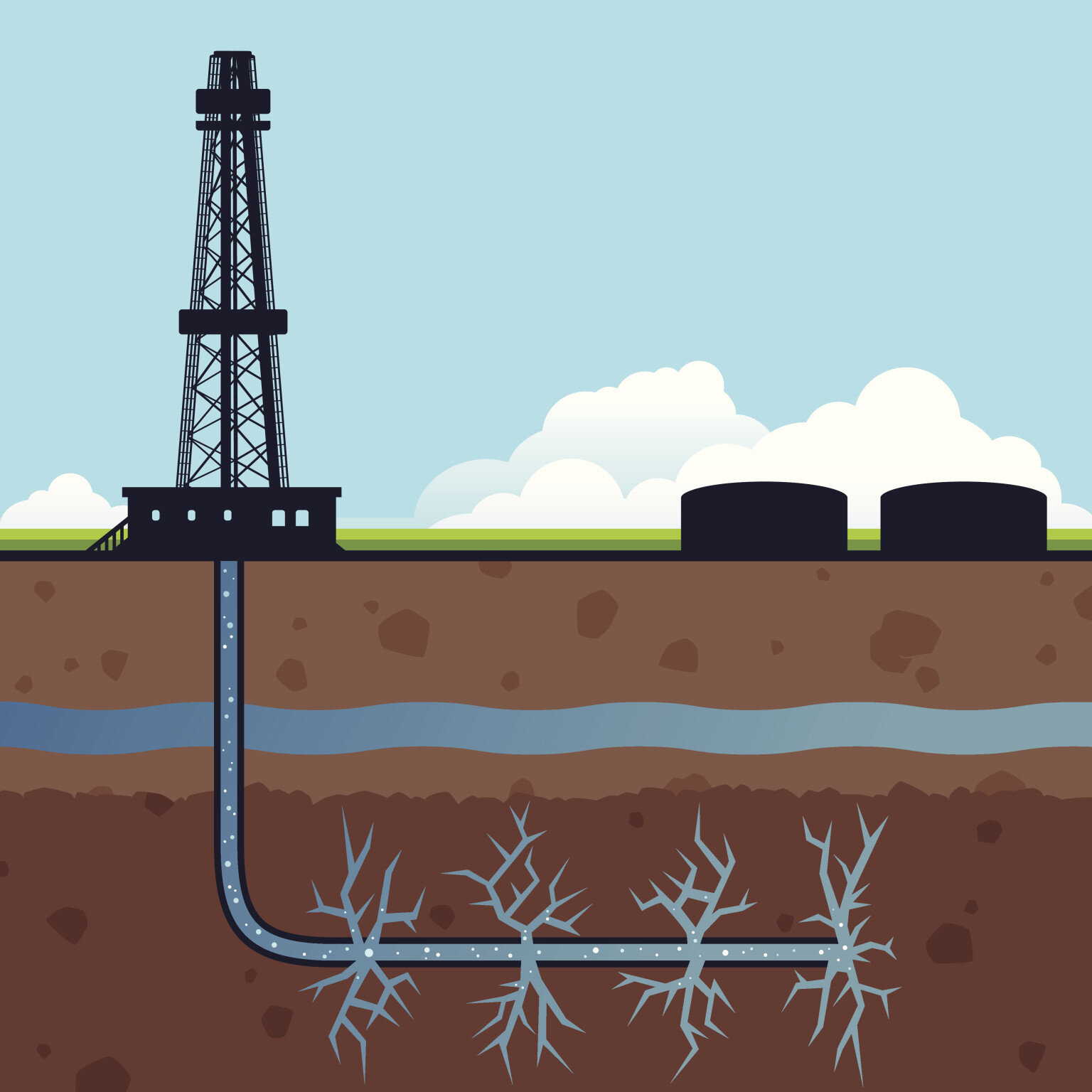

It's important to understand how the US was able to do this. By now, almost everyone has heard of the fracking revolution. But what exactly does this mean? Essentially a few US companies, notably Mitchell Energy, were able to finally "crack the code" in terms of how to get oil out of rock that previously did not yield economic return. What does this look like?

Simplistically, oil companies historically drilled down vertically or diagonally until they struck the oil and then it was extracted. Of course it is significantly more complicated than that but that's the gist of it. If you have seen the movie "There Will be Blood" with Daniel Day Lewis, he compared it to sticking a straw down and sucking the oil out of the ground. The problem with this is that eventually most of the major onshore locations were found and oil production in the US decreased...meaningfully. In the chart above you see this represented from 1985-2007 as oil fell from over nine million barrels a day to five million a day.

Along came a number of entrepreneurs who believed they could get at a whole new source of oil...oil that was trapped in "shale rock". As we understand it, most oil industry veterans agreed there was oil in the shale rock (although not nearly the extent it turned out to be) but they thought there was no economic way to extract it. So how did these entrepreneurs get the oil?

They combined horizontal drilling, which is drilling down to a certain depth and then literally turning the drill bit horizontally and drilling laterally, with fracturing. Fracturing is the process of pumping large amount of water, sand and other chemicals into the rock in order to "fracture the rock" and capture the oil that is captured in the rock. Here is a picture that demonstrates this.

Source: http://i.huffpost.com/gen/1211740/images/o-FRACKING-facebook.jpg

So they figured out the technology but they also had to get a little bit lucky, namely (i) oil had to be high given the fracturing cost and (ii) financing had to be available because these new wells were expensive. These wells cost $10M+ as compared to a historical vertical well that was a tenth of that.

Everything aligned however as oil prices rose significantly after the Great Recession and the Fed brought interest rates down to zero. All of a sudden fracking became economical and the banks were more than willing to finance the wells. Fracking also brought along a key benefit for the banks. Fracking produced very few "dry wells". In other words if you spent the money, you would find the oil. This means the banks knew they had a low chance of lending into a bunch of dry wells that would cause them to lose their money.

Therefore, boom, we have a revolution on our hands. This was great for about five years as the global economy rebounded, led by China, and demand increased. As supply finally passed demand, the oil industry had another major issue on their hands and this time it was technological.

Most people do not think of the oil and gas industry as being overly technological. You drill and suck it out right? In reality there is a massive amount of technology that goes into identifying locations to drill and then the drilling process itself. And the oil companies were not simply sitting tight. They were getting better and better at drilling the oil. This means their break-even costs were coming down rapidly on fracking the wells.

Previously they were drilling horizontally across acres...now it is miles and miles at a time. Previously they would drill one well, now they are drilling multiple wells from the same platform and hitting different layers of rock along the way. In addition they continued to get smarter on the fracking combinations of water, sand, etc.

By the time oil prices started getting wobbly (2H14) we had in many ways a perfect storm on our hands in the US. Namely:

- We were drilling at an unprecedented rate

- Much of this was financed by low-rate debt

- The technology continued to improve lowering the break even cost

- Companies were not dumb and hedged their production out a number of years meaning even if oil fell they could still sell it for say $70/barrel for the next year to two years depending on how far out they hedged

So what happens when oil prices start to fall and OPEC in Nov14 effectively declares a price war? Instead of a massive wave of bankruptcies as the oil price collapses, US companies actually produce more and more oil throughout most of 2015. This adds to the glut and exacerbates the decline in oil prices. Why?

- Many fracking companies were overly indebted and had to produce more and more oil to make the same amount of money

- Technology continued improving and the producers went to their service suppliers and demanded massive price discounts...lowering the cost of the wells even more

- The companies' hedges kept a lot of them in business when otherwise they would be bankrupt

The need to produce more and more oil to try to keep up revenues was not just an issue for the US. This is also a major issue for countries around the world that depend on oil prices. Therefore we also saw OPEC increase production in 2015 as they tried to keep their budget deficits as low as possible.

Everything is now coming to a head in 2016. Most of the hedges are gone and there are a large number of producers that will be out of business shortly. In addition to the producers a large amount of the supply chain (servicers, etc.) will go bankrupt. Banks have been slow to force bankruptcies but once it starts it should cascade. The good news is that there is a massive amount of money, tens of billions just in private equity, plus the more insulated large public companies that will likely be active. A lot of money will be made here by savvy distressed investors...we will not participate.

In terms of what this means for the economy, it really isn't clear. The stock markets are now tracking oil's decline which is a reversal of the mid-2000s when oil was skyrocketing and the market moved inverse with the price. The lower price at the pump is undoubtedly a large savings for US consumers. However, the largest source of job growth since the Great Recession was the energy sector. Now the sector is seeing massive layoffs, many of which are high earning jobs. These cut jobs also have a multiplier effect on the economy as the car dealer who would have sold the oil man a nice truck may not see that sale anymore. Then the car salesman may reduce his spending as a result, impacting his local economy, and so on and so forth. We do not know if this will have a massive spillover effect on the economy or not, but we believe it is something to keep a close eye on and it is worth avoiding most businesses that have direct exposure to this sector, at least for another six months.

Therefore, onto 2016 expectations: We expect the sustained lower oil prices, high amounts of debt and lack of hedges will force more producers into bankruptcy. Therefore, we believe the only energy-related stocks that can be touched at this point are the ones with fortress-like balance sheets and not those with huge amounts of debt. We expect the bankruptcies to provide some issues for banks who own large concentrations of energy-related debt. We expect sustained higher volatility in the sector in both equity and debt prices. On the positive side, we expect the bankruptcies and cuts in production to eventually balance out the supply/demand equation and provide some support for prices in the back half of 2016.

We would also note that there does not to be any kind of geo-political risk premium currently factored into the price of oil. With Russian, Middle East and ISIS tensions high, there is always potential of some kind of large supply disruption which could provide a supply shock for oil markets and send prices higher.