2015_12_1 Fortis Musings

We will use the "Fortis Musings" blogs to provide interesting articles and thoughts from our daily reading material. Hopefully it provides some insights into our thinking. This being our first it will be a bit longer than normal.

Equity Markets

The markets were happy today. While nobody really knows why the market does what it does, the November ISM (Institute for Supply Management) US manufacturing number today showed contraction in at 48.5 (anything below 50 is contraction) vs. estimates of 50.5. The markets may have taken this to mean either a December rate hike is less likely or at a minimum future rate hikes may be slower than expected.

Special Situations

Shaping up to be a slow week in this department. Mario Gabelli's GAMCO is spinning off part of its business but otherwise no spin-offs or other special situations should be occurring. We looked at the spinoff (Associated Capital) and are performing some preliminary due diligence around it.

M&A

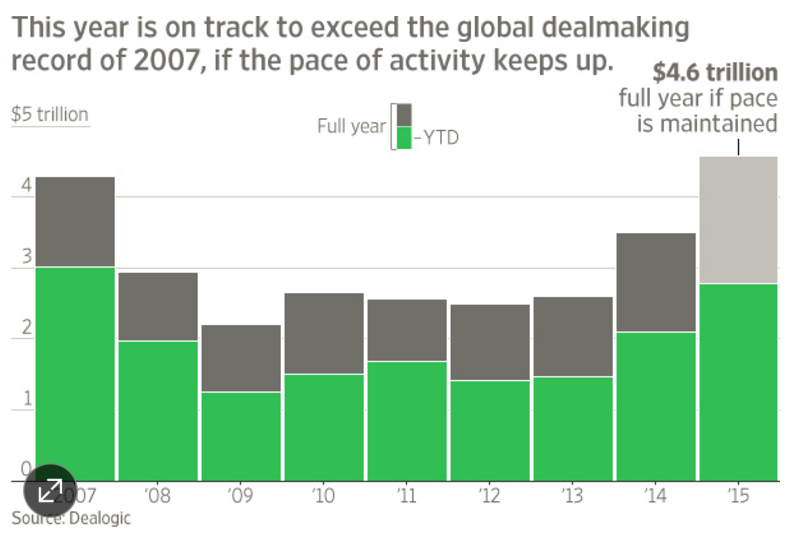

Generally a sleepy day for M&A notwithstanding news of Mattress Firm Holding Corp (MFRM) buying Sleepy's. 2015 should set an all time high for M&A, surpassing 2007.

The question of course is why is M&A so hot. Everyone has an opinion and ours is:

- Debt has been and is historically cheap

- Organic growth (the growth you generate from selling more of your own product or a new type of product that you create within your own company) is minimal in the developed world given the slow economic growth. So if you want to grow beyond low single digits you have to acquire something

- CEOs tend to be empire builders and without growth life gets pretty boring

It does seem the party may be coming to an end with a couple of banks unable to sell off the leveraged loans they underwrote for a couple of transactions, most notably Carlyle's purchase of Veritas from Symantec. As the article notes the banks will be on the hook for the entire balance if they cannot sell them by Jan16. We would note however that this is called underwriting for a reason and there is risk out there even if it rarely pops its head up.

IPOs

On the other side of the dial, we also like to look at what is coming public because it provides an interesting barometer or how good the market is feeling. Of course all of this is sector specific, etc, etc. There is no right answer. Neither of us has ever bought into an IPO because, outside of getting an allocation from the banks, they tend to be too richly priced.

The market for IPOs is decidedly non-plussed at the moment and 2015 has been the worst year from a dollar perspective for IPOs since 2009.

Source:http://www.nasdaq.com/article/december-2015-us-ipo-preview-who-will-brave-the-market-before-year-end-cm548346

So what exactly is going on? The number of IPOs is not nearly as bad as the dollar value of IPOs. Acquisitions are going to be at an all time high this year. A couple of things help explain this:

- This has not been a good year for the equity markets in the US...in fact outside of a few stocks it has been pretty lousy

- There has been a lot of money available to private companies that historically only would be available through the IPO market. This is certainly going to be slowing down outside of the top companies.

- In conjunction with number two, most people don't have a huge desire to go public anymore and if you can raise money as a private company that is in many ways a lot better. Being public means the CEO will be required to spend a lot more time talking to investors, having quarterly calls, etc. If not managed appropriately it can be a gigantic time suck. For example Jimmy Johns (yes the sandwich company) pulled its IPO today because Jimmy John (the CEO) is "not a Wall St. guy".

- There is a lot of money sloshing around in the private equity firms' bank accounts. The PE firms can in many cases simply sell their companies to other PE firms and rinse and repeat without having to go through an IPO. In many cases the private market valuations are a lot better than the public markets are currently providing.

The dollar size of the average IPO is also dramatically smaller. This is something that deserves its own post so we will save that for later.

There are only two IPOs "on deck" for this week:

- Pulte Acquisition Co (PLTEU) - A special purpose acquisition company (SPAC) which we are quite familiar with through our ownership of WLRH, a SPAC run by Wilbur Ross. PLTEU is looking to raise $70M on 7M shares at $10.

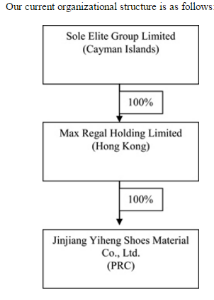

- Sole Elite Group (SOLE) - A China based footwear sole manufacturer looking to raise $12M or so. The audited accounts indicate the company is solidly profitable and in general one would expect that over a long term period footwear sales in China should be well. That being said, we can find other places to make money rather than trying to buy into a footwear company based in China with this org structure:

Source: Company F-1

To summarize, the IPO market certainly isn't frothy at the moment (see November's IPOs of Match Group and Square which each priced well below the expectations) despite a relatively high multiple on the S&P 500.

Credit Markets

Goldman today told the world not to worry too much about the rising credit spreads. Credit spreads are the amount various categories of bonds trade above government bonds. The higher the spread the riskier the asset. Recently spreads have been increasing which means the bond market is indicating things may not be "all good" beneath the surface in spite of near-record equity markets. Goldman's take is that the world's economy will continue to clip along and the current spreads are providing good bargains.

Meanwhile the Fed Presidents continue to give speeches, interviews, etc. While Janet Yellen does not sit atop a dictatorship telling everyone what to do, it is known the members tend to coordinate their speeches to guide the market and tell the story they want to. Today we got Charles Evans, the Chicago Fed chief, and one of the biggest doves in the group. The gist of his comments are:

- Unless inflation ticks up we are going to move really really slow (i.e., less than 1% rates by the end of 2016)

- We really need to let the market know how slow we are going to move.

By this point it is clear the Fed is going to raise unless something traumatic happens and the pace of the future rate rises (in an ELECTION year) will be very very slow. From our perspective, unless the market falls apart, this should be very positive for quality yield securities which have been somewhat indiscriminately sold off ahead of the rate rise.

Despite all of this rising credit spreads is not a good thing for the equity markets and something to keep an eye on. This may prove to be especially serious in emerging markets where default rates are increasing. A combination of weaker growth/earnings in the emerging economies and increased debt balances from $USD denominated debt could become a significant issue and is something we are watching closely.